Key features

- A 3-year bond whose semi-annual interest payments are linked to average annual inflation, subject to a minimum interest rate of 2.00%.

- Principal will be repaid in full (i.e. 100%) at maturity.

Interest determination mechanism

- Interest payments will be made on the scheduled interest payment dates at the end of every 6 months in arrear, based on the per annum interest rate determined and announced on its relevant interest determination date.

-

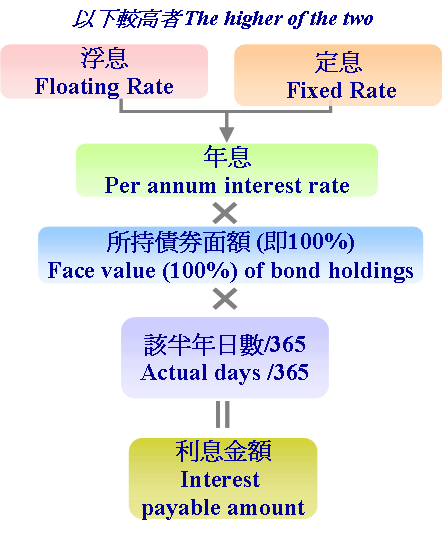

The relevant per annum interest rate determined and announced on each interest determination date is the higher of:-

- the floating rate, being the arithmetic average of the year-on-year rates of change in the Composite Consumer Price Index compiled and published by the Census and Statistics Department of HKSAR Government based on the results of the most recent Household Expenditure Survey at the relevant interest determination date for the 6 most recent preceding months, rounded to the nearest two decimal places; and

- the fixed rate of 2.00%.

- The amount of interest received on an interest payment date would be the applicable per annum interest rate * the principal amount of bonds you hold (i.e. face value of 100%) * actual number of days in that interest accrued period on the basis of a 365-day year.

- A more detailed description can be found in the relevant issue circular.

Secondary trading

- When bonds are being traded in the secondary market, interest due from the last interest payment date to the settlement date, or in the case of a transaction that is settled before the first interest payment date, from the issue date to the settlement date, is normally paid to the bond seller from the bond buyer. The amount of interest to be paid is calculated in the same manner as an interest payment.

- If the transaction is settled before the first interest payment date, the applicable per annum interest rate is the one announced by the Government in advance. This rate is determined based on the higher of the Fixed Rate or relevant Floating Rate of the relevant bond. Please note that this is not the actual per annum interest rate for the first interest payment date.

- If the transaction is settled after the first interest payment date, the per annum interest rate used in calculating accrued interest will be that of the immediate preceding interest payment date.

- Relevant interest rates are set out here.